If you know how much you have to spend each month, you’re less likely to buy something you can't afford.įor instance, let's say that your net monthly income after withholdings for taxes, Social Security and Medicare is $4,000 per month (otherwise known as your take-home pay). Knowing and monitoring your monthly expenses is important because it can help you avoid overspending. Why monitoring your monthly expenses is important For instance, personal care, such as haircuts, manicures and pedicures, may not be a precise monthly expense, but it is something you budget for every six weeks or so. The above are examples of monthly expenses, however, your personal finances may reflect other recurring expenditures that you've built into your monthly budget.

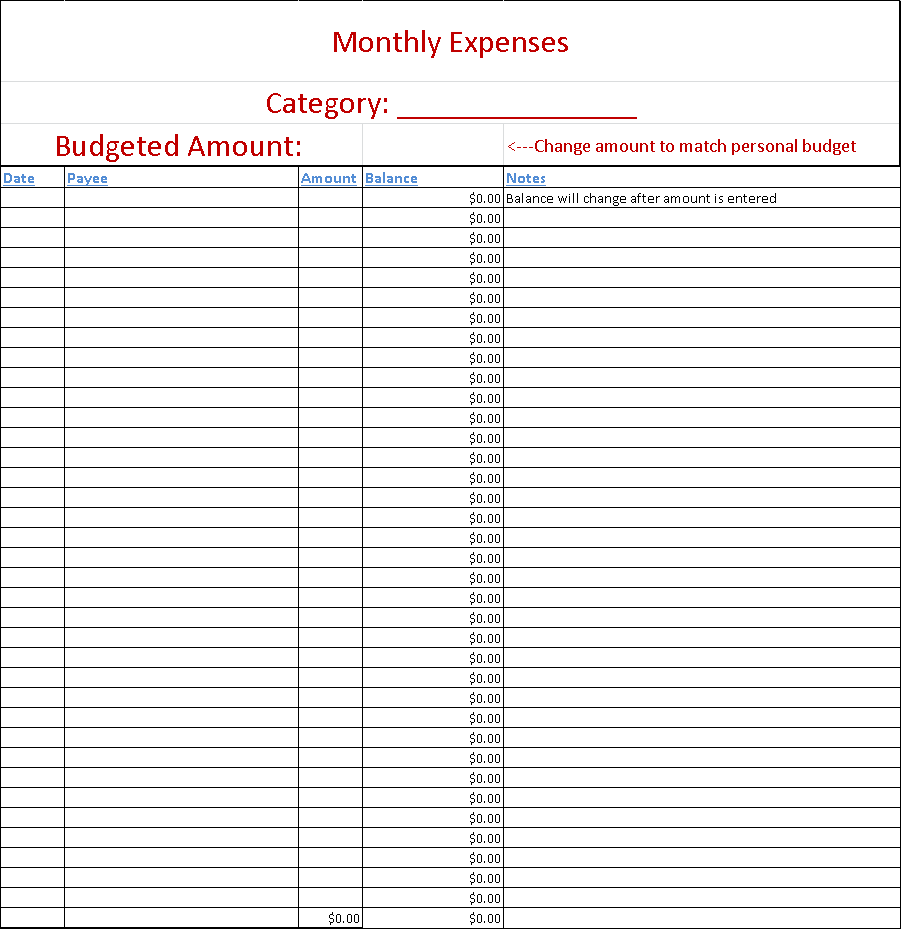

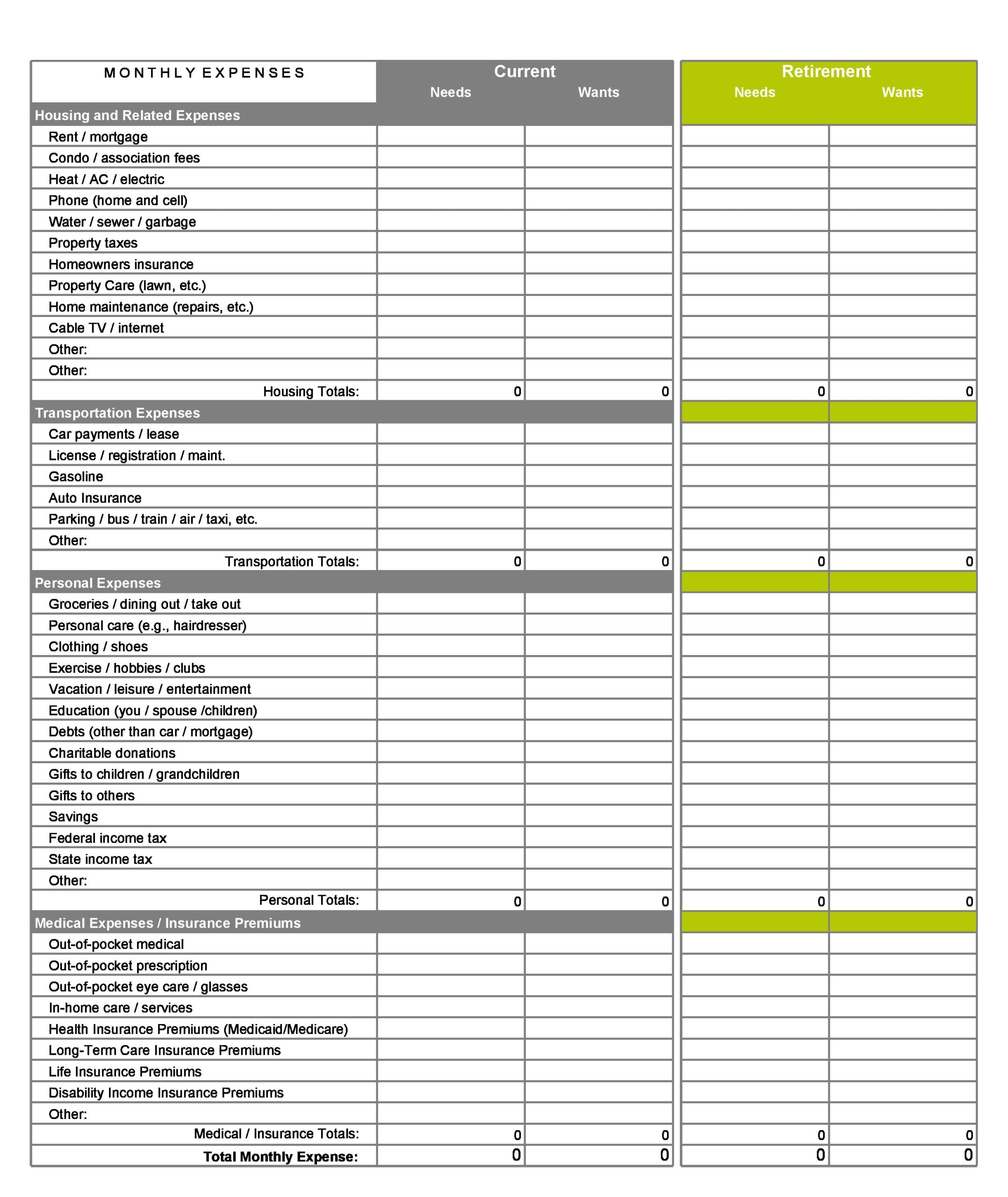

Other routine expenditures, such as subscription services and cable Transportation expenses, such as public transportation costs Insurance payments, like health insurance, car insurance, life insurance, renter’s insurance, homeowners insurance and pet insuranceĬhild care, such as daycare and babysitters The types of purchases that may appear on your monthly expenses list include: Purchasing a new TV, however, would not typically be considered a monthly expense - unless you were consistently buying one every four weeks or you financed the purchase and owe monthly payments. A housing cost, like your rent or mortgage payment, would be one such example since you owe this every month. Creating a monthly expenses listĪ monthly expense is one you pay on a regular monthly cadence. In this article, we’ll outline what should be on your monthly expenses list, why it's important to monitor these expenses and five ways to reduce them. One way to more closely evaluate your spending habits is by looking at a list of your monthly expenses. Do you find yourself living paycheck to paycheck? Are you aiming to make monthly debt payments or fund a retirement account but can’t seem to figure out why your cost of living expenses are so high? If so, you may want to take a closer look at your spending habits.

0 kommentar(er)

0 kommentar(er)